Navigating the Money Maze: Introduction to the financial challenges faced by U.S. families

As an experienced financial advisor, I have witnessed firsthand the various financial challenges that families in the United States are currently facing. From the rising cost of living to the burden of debt, it can be overwhelming to navigate the money maze. In this article, I will explore eight common financial issues that U.S. families face today and provide strategies to overcome them. Navigating the money maze requires financial aptitude, the lack of which almost always guarantees failure in multitudinous areas.

Importance of having sufficient emergency savings

One of the most critical aspects of financial stability is having sufficient emergency savings. Life is unpredictable, and unexpected expenses can arise at any moment. From medical emergencies to car repairs, having a safety net is crucial. Experts recommend saving at least three to six months of living expenses in an emergency fund. By prioritizing savings and setting aside a portion of your monthly income, you can build a solid foundation for financial security.

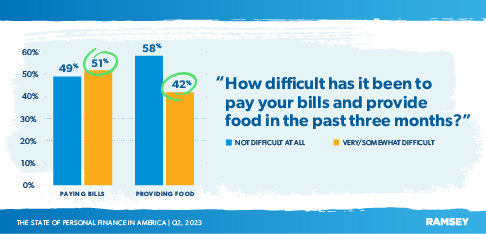

Strategies for covering everyday expenses

Covering everyday expenses is another challenge faced by many U.S. families. With the increasing cost of groceries, utilities, and transportation, it can be difficult to make ends meet. Creating a budget and tracking your spending is essential to navigate this issue. Identify areas where you can cut back, such as dining out or entertainment expenses. Consider using coupons or shopping during sales to save money on groceries. Additionally, exploring ways to increase your income, such as taking on a side gig or freelancing, can provide extra funds to cover daily expenses.

Dealing with debt and finding solutions

Being in debt is a common financial issue that can significantly impact a family’s financial well-being. It is essential to tackle debt head-on and develop a plan to pay it off. Start by organizing your debts and prioritizing them based on interest rates. Consider debt consolidation or balance transfers to reduce interest payments. Explore options such as debt settlement or working with a credit counseling agency to negotiate more manageable payment terms. You can regain control of your financial situation by proactively addressing your debt.

Building and maintaining discretionary funds

Having sufficient discretionary funds is crucial for maintaining a balanced financial life. Discretionary funds are the extra money that can be used for leisure activities, vacations, or unforeseen expenses. To build and maintain discretionary funds, it is essential to prioritize saving and avoid unnecessary expenses. Look for ways to increase your income, such as investing in side businesses or pursuing passive income streams. Set clear financial goals and automate your savings to ensure steady progress.

Planning for retirement and ensuring sufficient savings

Planning for retirement is a financial issue that should not be overlooked. Many families in the U.S. are not adequately prepared for their retirement years. To ensure sufficient savings, it is crucial to start saving early and take advantage of retirement accounts such as 401(k)s or IRAs. Consider consulting with a financial advisor to determine your situation’s best retirement savings strategy. Additionally, explore alternative retirement income sources such as rental properties or dividend-paying stocks to diversify your income streams.

Planning for Retirement Must Include More Than a Savings Plan ~ Passive Income Is the Answer

While having a savings plan is essential for retirement, relying solely on savings may not be enough. With the changing economic landscape, it is crucial to explore additional sources of income, such as passive income. Passive income streams, such as rental properties, dividends, or royalties, can provide a steady income during retirement. Diversifying your income sources can ensure a more secure financial future.

Register for the 7-Day Online Business Launch Course and Learn how to create multiple income streams online in record time.

Affording quality housing and managing housing costs

The ability to afford quality housing is a significant concern for many U.S. families. Housing costs, including rent or mortgage payments, property taxes, and maintenance, can consume a significant portion of a family’s budget. To navigate this issue, it is essential to budget and plan accordingly. Consider downsizing or exploring more affordable housing options. Research local programs or grants that can assist with housing costs. Additionally, explore strategies such as house hacking or renting out a portion of your property to generate additional income.

Ensuring stable income and finding employment opportunities

Having a stable income is crucial for financial security. However, finding employment opportunities can be challenging, especially in a shifting job market. Staying competitive and continuously improving your skills is essential to ensure a stable income. Invest in your education and consider pursuing certifications or advanced degrees. Additionally, explore alternative employment options such as freelancing or starting your own business. By creating independent streams of income, you can safeguard your financial future.

Creating Your Own Opportunities In a Shifting Job Market ~ Creating Independent Streams of Income

In a shifting job market, being proactive and creating your own opportunities is essential. Rather than relying solely on traditional employment, consider creating independent income streams. This can involve starting a side business, freelancing, or investing in income-generating assets. By diversifying your income and taking control of your financial destiny, you can confidently navigate the challenges of a changing job market.

Evaluating investment portfolio performance and making adjustments

Investing is a crucial aspect of building wealth and securing your financial future. However, it is essential to regularly evaluate your investment portfolio’s performance and make adjustments as needed. Assess the risk-reward ratio of your investments and ensure proper diversification. Consider consulting with a financial advisor to review your portfolio and identify potential areas for improvement. Stay informed about market trends and adjust your investments to maximize returns while minimizing risk.

Understanding Cost (Taxes, commissions, Etc.), Asymmetric Risk Reward, Diversification, Risk Assessment

To effectively manage your investments, it is crucial to understand key concepts such as cost, asymmetric risk-reward, diversification, and risk assessment. Costs, including taxes and commissions, can significantly impact your investment returns. Assess each investment’s potential risks and rewards and ensure a balanced portfolio through diversification. Regularly evaluate the risk level of your investments and make informed decisions based on your risk tolerance and financial goals.

Conclusion and resources for further financial assistance

Navigating the financial challenges U.S. families face requires careful planning and proactive steps. Families can achieve excellent financial stability by addressing issues such as emergency savings, everyday expenses, debt management, retirement planning, housing costs, stable income, and investment performance. Remember to invest in yourself and continuously educate yourself about personal finance. Consider enrolling in the Legacy Wealth Academy’s Path to Generational Wealth course for further assistance. Prepare yourself to navigate the labyrinthine corridors of the money maze and secure a prosperous financial future.

Invest in yourself. Enroll in the Legacy Wealth Academy’s Path to Generational Wealth course and prepare yourself to navigate the labyrinthine corridors of the money maze! Click Here!

Additional Reading:

Beyond the Paycheck: Discovering the 5 Hidden Benefits of Having Multiple Sources of Income

The Imperative of Diversification: Unlocking Financial Freedom Through Multiple Streams of Income

Mastering Your Finances: The 7 Key Steps to Achieve True Financial Freedom

Unleashing the Power of Habit: How Your Daily Routines Shape Your Future

0 Comments